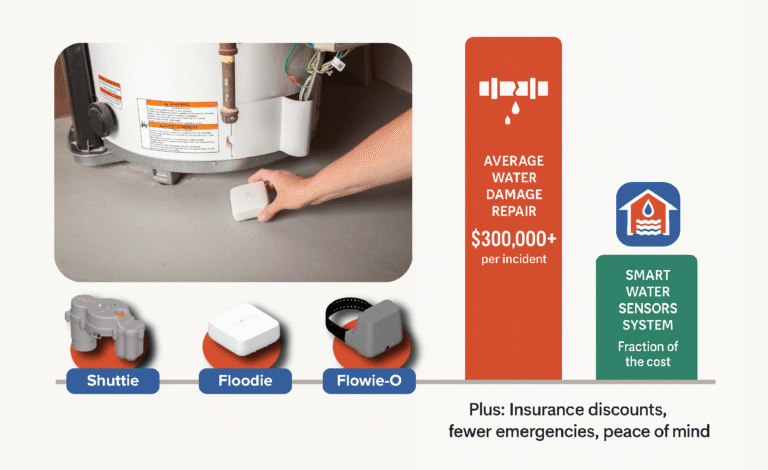

Water damage represents the leading preventable loss across all commercial property types, yet most property managers underestimate the true scope of financial exposure they face. While the basic causes remain consistent—burst pipes, HVAC failures, and aging infrastructure—the financial impact varies dramatically based on property type and complexity. Understanding these risk differentials is crucial for developing appropriate protection strategies and insurance coverage.

| Property Type | Claim Frequency | Average Cost | Impact Scope |

|---|---|---|---|

| Residential | 1 in 60 annually | $12,514 - $13,954 | Single family |

| Commercial | Leading cause of claims | $24,000+ | Business disruption |

| Multifamily | 70% report as top issue | Higher severity | Multiple units affected |

Smart Water Sensors work as your silent workforce—monitoring 24/7, never taking breaks, responding faster than any maintenance team could.

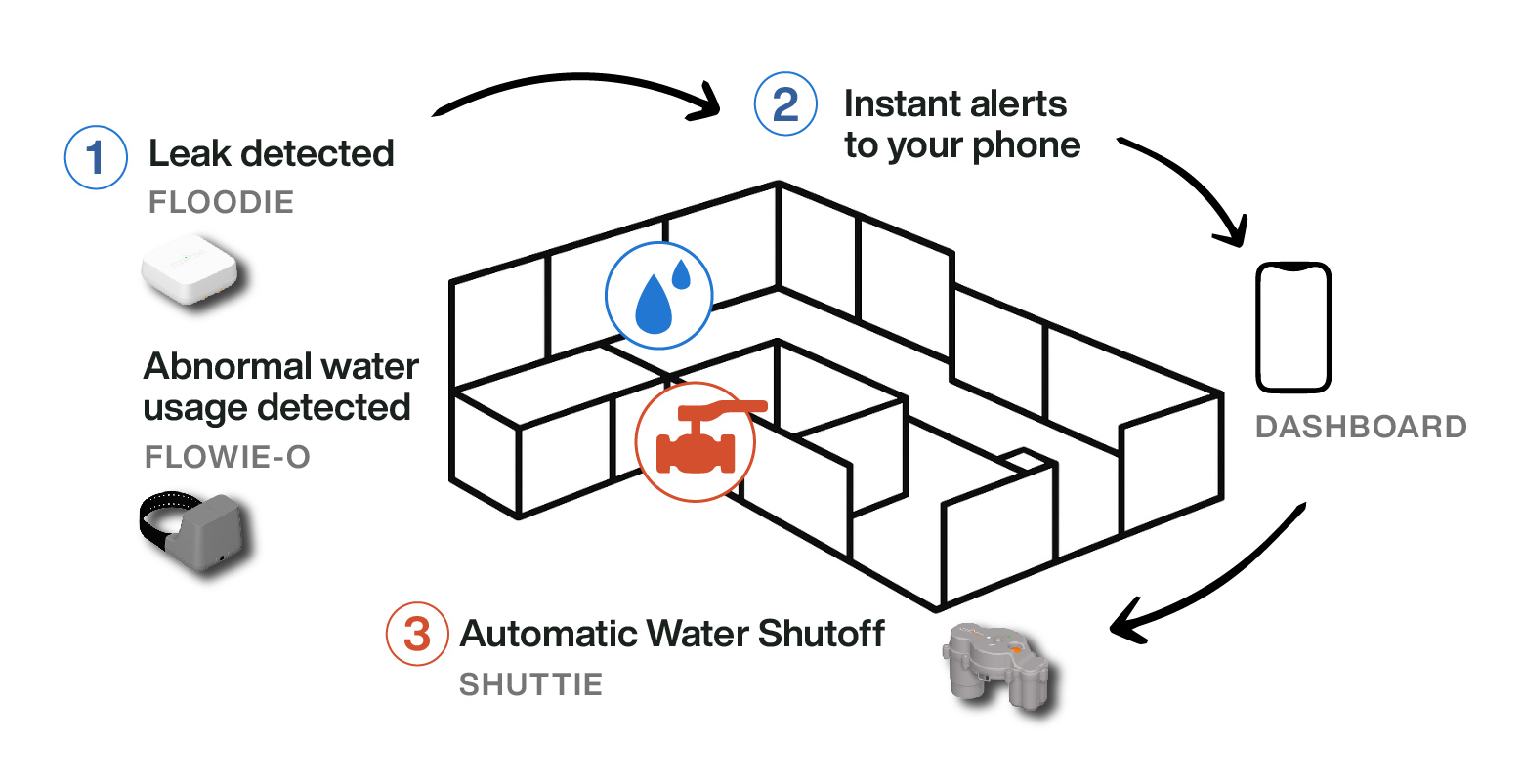

AI-powered water detection systems, consisting of flood detection sensors and automatic shutoff valves, offer two distinct levels of protection.

Your Digital Watchman

Your Automated Response Team

The best water protection strategy is the one that fits your property's unique needs. Passive protection provides excellent monitoring and alerts for properties with responsive staff. Active protection adds automated response for high-risk scenarios or unstaffed properties. Think of your system as a silent workforce, always on duty to safeguard your property, your budget, and your reputation.

Ready to deploy your virtual water management team? Smart Water Sensors' integrated approach transforms leak detection from a reactive maintenance issue into proactive asset protection.

Sources: Insurance Information Institute (III), Federal Emergency Management Agency (FEMA)